Industry News

New technologies, changes in our society and environment present new opportunities, but also harbour new risks. We support our clients and help them to identify new risks at an early stage. Changes in legislation including new business laws, and Case law, affect the way all businesses operate.

Theft and Malicious Damage

A recent survey of the top 500 small and medium sized companies has revealed that Theft and Malicious Damage remains in the top five threats to their business. Cyber might be the number one threat to SME’s, but old-fashioned theft is still a major concern. This isn’t...

Buyer beware – it’s a ‘hard’ market !

After over a decade of soft market conditions, the insurance industry is experiencing upheaval– with fewer insurance providers, reduced appetite for risk and capacity.

Professional Indemnity Insurance – Contractors Design & Construct

Professional Indemnity insurance in the design and construction sector is changing rapidly leading to some organisations unable to arrange the professional indemnity insurance required to support their business.

Aquaculture – Insurance & Stock Mortality

A fish farmer will usually aim to arrange Stock Mortality insurance either on either a Named Perils or ‘All Risks’ basis. The problem for the fish farmer is that other than in Norway, there are currently a limited number of insurers who can provide insurance on a direct basis.

Business Risk Barometer

The annual Allianz Risk Barometer identifies top business threats based on the insight of risk management experts from the UK and around the world. Here we look at the threats ranked most important by UK respondents.

Supply Chain Risk Management Solutions

In 2017 cargo crime accounted for over £55 million worth of goods stolen in the UK. The insurance market continues to react to policyholder’s supply chain concerns. Many insurers are working in partnership with organisations providing supply chain services including...

Business interruption – what is your risk?

A manufacturer had a fire at their premises and lost everything. When they took out their insurance they had decided that they could recover from any major event within twelve months and therefore had taken out insurance to cover them for loss of income over that...

The Overlooked Gap in Cover – Terrorism Insurance

2017 has seen an increase in the terrorism threat in the UK and the type of attacks has changed from primarily property damage to increasing violent attacks focussing on fear, chaos and loss of life, sometimes with no or minimal property damage, but with business left...

Artificial Intelligence – Implications for UK business

AI technologies will provide new market opportunities and competitive advantage. Perceptive organisations are already investing their time to determine whether there are opportunities to benefit from AI. These new technologies will require a different set of skills...

Commercial Crime Protection

Crime is an increasing threat to all organisations. The recent PWC global economic crime survey identified the following trend. 34% of companies had experienced economic crime in the last 12 months; a rise of 13% 54% of those companies were large, categorised as...

Product Recall & Liability

UK business face unique challenges – Product Recall & Liability A product recall can devastate a company’s reputation, brand name and profitability. No matter what its size or industry, a company can be left in ruins if it does not manage a product recall...

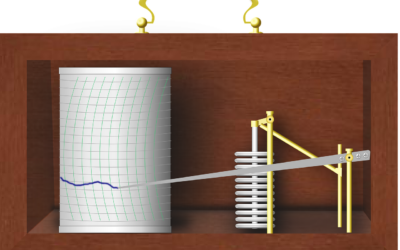

Thermographic surveys – are they essential for your business?

Electrical system failure is a major concern for all companies. Recent statistics from leading insurers show that 35-40% of all fires are caused by electrical faults and the impact upon a business can be severe leading to significant losses. You can take away the...

Environmental threats

Property owners and companies are becoming increasingly aware of the legal and financial threats that can result from an environmental liability. Even seemingly ‘low risk’ land used such as retail parks, offices and leisure facilities can hold unexpected environmental...

A guide to making a claim

Almost everyone hopes that they will never need to use their insurance but if it becomes necessary, understanding how to navigate a path through the claims process is crucial. The payment of a claim is, at the end of the day, fundamentally what you are buying when...

DVLA cuts red tape for motorists

Motorists will no longer need motor insurance policies to be checked when getting their vehicle taxed. The changes come into force from 16th December and will also mean that motorists will only need to tell the DVLA once they declare their vehicle off road. The...

Health & Safety for small and medium sized business

Ae Insurance Brokers will always be willing to offer you guidance on what constitutes good practice in managing health and safety. This guidance should be aimed at improving the resilience of your business in dealing with civil law claims made against you, and will...

Employment Tribunals – a drain on company resource

The Ministry of Justice has published its latest report on the cost of Employment Tribunal and Employment Appeal Tribunal cases in the UK for the period April 2012 to March 2013. This shows that there has been a 3% increase in tribunal claims compared with the same...

Perils of Underinsurance

Too many businesses are risking their survival and making it difficult to bounce back successfully from a major claim. A significant problem is underinsurance and brokers and their clients need to work together to ensure that when a loss occurs the insurance policy...

Riot Reforms – Riot Damages Act 1886

Following calls from the insurance industry for urgent government reforms relating to riot damage, the government has announced a review of the Riot Damages Act 1886. The Association of British Insurers responded quickly to the riots and have now settled over 98% of...

Strict Liability – Employers Claims

There have been recent steps by the government towards an abolition of strict liability in Employers’ Liability cases by introducing a clause into the Regulatory Reform Bill. The Act has now received Royal Assent and its aim is to remove the right of civil action...

Contaminated Products Insurance – Protecting Your Brand and Business in the Event of a Recall

The number of product recalls is increasing, which is no surprise considering the fact that product contamination has been front page news recently. This has meant that protecting your manufacturing, retail or distributing business against recalls of contaminated...